PakCredit App Fast & Flexible Personal Loans in Pakistan 2025

Description

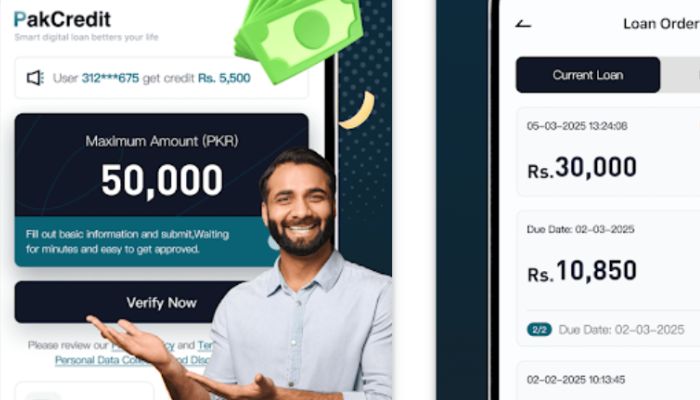

When financial emergencies hit, having a reliable and instant loan solution can feel like a life saver. That’s exactly where PakCredit powered by Visioncred Financial Services (PVT) Ltd an SECP licensed NBFC steps in. With its promise of fast, flexible personal loans of up to PKR 50,000, secure transactions, and a fully digital process, it is quickly becoming a popular choice among Pakistan.

Whether you’re stuck with unexpected bills, need some breathing room before payday, or simply want a safe credit option without long approvals, this complete review will help you understand everything about PakCredit.

What is PakCredit?

Pak Credit is a digital personal loan service in Pakistan that provides quick loans ranging from PKR 5,000 to PKR 50,000. The platform offers fast approvals, secure transfers, and fully online processing making it a reliable option for anyone looking for short term financial support. It is designed to be simple, user-friendly, and accessible to working individuals, students, freelancers, and everyday users who need effortless financial assistance without lengthy documentation.

Who Owns PakCredit?

PakCredit Loan is operated by Visioncred Financial Services (PVT) Ltd, a legitimate SECP licensed Non Banking Financial Company (NBFC) in Pakistan.

That means:

- It operates legally

- It follows Pakistan’s financial regulations

- Your data and transactions remain protected under local financial laws

This is a major advantage, because many digital loan apps are not licensed it stands out as a compliant and trustworthy platform.

Why Pak Credit Loan is Getting Popular in Pakistan

It is gaining attention for its speed, flexibility, and transparent process. Instead of visiting a bank, filling long forms, and waiting days for approval, users can get credit within minutes using only a mobile phone.

People prefer PakCredit App because:

- Approval is fast

- Requirements are minimal

- It offers small but helpful loan limits

- Transfers are instant and secure

- It is backed by a licensed Pakistani financial company

For many users, it’s the quickest and safest alternative to bank loans.

Key Features of PakCredit

Fast Loan Approvals

Most applications are approved within 5 to 30 minutes, depending on your verification.

Flexible Loan Amounts

Borrow as little as PKR 5,000 or as much as PKR 50,000, depending on your profile.

Easy Repayment Options

Repay through multiple digital wallet methods:

- Easypaisa

- JazzCash

- Bank Transfer

Simple Application Process

No heavy paperwork.

No office visits.

Everything is mobile based.

Secure & Encrypted Transfers

PakCredit uses financial grade security systems to safeguard user data and digital payments.

Licensed by SECP

The biggest plus it operates under a legally registered NBFC. That adds legitimacy and trust.

Customer Support Availability

Users can contact the official support team for queries related to loans, repayment, or app usage.

Loan Amounts and Limit Options

Pak Credit offers the following loan limits:

| Loan Type | Amount | Tenure |

|---|---|---|

| Small Loan | PKR 5,000 – PKR 15,000 | 14–30 days |

| Medium Loan | PKR 15,000 – PKR 30,000 | 30–60 days |

| High Loan | PKR 30,000 – PKR 50,000 | 60–90 days |

Your limit depends on:

- CNIC verification

- Employment details

- Repayment history

- Credit score within the platform

Eligibility Requirements

To apply for a PakCredit Loan App you must meet the following conditions:

Pakistani citizen

Valid CNIC

Age between 18 to 60

Active mobile number

Regular income source (job, freelancing, business, or household earnings)

Valid bank account or mobile wallet

It accepts users from all cities of Pakistan.

Step by Step Loan Application Process

Download the Pak Credit Loan App

Click the given download button and folow instructions to Download PakCredit.

Create Your Account

Use:

- CNIC

- Mobile number

- Verified OTP

Fill Out the Loan Application

Provide basic details:

- Name

- Address

- Monthly income

- Employment type

Upload Required Documents

Usually:

- CNIC front & back

- Selfie for live verification

Choose Loan Amount

Select between PKR 5,000 to PKR 50,000.

Submit and Wait for Approval

Most users receive a decision within minutes.

Receive Funds

Money is sent directly to:

- JazzCash

- Easypaisa

- Bank Account

Required Documents

It keeps documentation minimal. You only need:

- CNIC

- Mobile number

- Selfie verification

- Basic personal details

No office letter, bank statements, or salary slips are required for small loans.

How Long Approval Takes?

Approval time varies from 5 to 30 minutes depending on:

- Network issues

- Verification status

- Accuracy of information

Returning borrowers often get instant decisions.

Repayment Process Explained

Repaying your Pak Credit Loan App is simple:

- Open the App.

- Go to Repay Loan.

- Select JazzCash, Easypaisa, or bank transfer.

- Pay the displayed amount.

- Confirmation arrives instantly.

Timely repayment increases your loan limit for future applications.

PakCredit Fees & Charges

While fees may vary, the typical structure includes:

- Processing fee

- Service charges

- Interest rate depending on tenure

There are no hidden fees, and everything is shown before confirming the loan.

Is PakCredit Licensed and Safe?

Yes, it is completely safe because:

- Operated by Visioncred Financial Services, an NBFC

- Licensed by SECP (Securities and Exchange Commission of Pakistan)

- Uses encrypted data protection

- Follows Pakistani lending regulations

- Your information, funds, and identity are safe.

Benefits of Choosing PakCredit

Quick Approval

No more waiting days for a bank loan.

Easy Documentation

Just CNIC and mobile number required.

Secure Transfers

Transactions happen through verified channels.

Support for All Users

Students, salary earners, freelancers, and homemakers can all apply.

Transparent Loan Details

No hidden terms or unclear deductions.

Higher Limits Over Time

Good repayment history increases credit score.

Potential Drawbacks You Should Know

Short Tenure

Loans must be repaid quickly (14–90 days).

Charges May Be High for Late Payer

Late payments may carry penalties.

Limited Higher Loan Amounts

Maximum is PKR 50,000, which may not meet all financial needs.

Not Ideal for Long Term Borrowing

It is meant for short term financial help.

Tips to Increase Your Loan Limit

Want a higher limit? Try these:

- Repay on time

- Provide accurate personal details

- Maintain a stable income

- Avoid multiple unpaid apps

- Build trust with consistent repayments

Customer Support & User Experience

Offers customer support through:

- In app support

- Social media

Users generally report:

- Quick assistance

- Fast problem resolution

- Helpful communication

The app’s interface is clean, smooth, and easy for beginners.

Final Thoughts

If you’re looking for a fast, flexible, and secure short term loan, PakCredit is absolutely worth considering. Its biggest strength is being operated by a licensed SECP regulated NBFC, giving it an edge over many unregistered loan apps in Pakistan.

With instant approvals, transparent terms, small but helpful loan amounts, and secure payment systems, Pak Credit Download App is perfect for anyone needing emergency funds without long paperwork or bank visits.

Whether you’re a student trying to manage expenses, a freelancer facing cash gaps, or a salaried individual needing a quick loan, PakCredit Download App offers convenience, trust, and support when you need it the most.

FAQs

Is it safe loan app in Pakistan?

- Yes! PakCredit is fully safe because it is operated by SECP licensed Visioncred Financial Services.

What is the maximum loan limit?

- You can borrow up to PKR 50,000, depending on your profile.

How long does Pak Credit take to approve a loan?

- Most approvals take 5 to 30 minutes.

Can students apply for a loan?

- Yes! Students with a valid CNIC and income source can apply.

What repayment methods does PakCredit support?

- You can repay through JazzCash, Easypaisa, or bank transfer.